Making money into more money seems really attractive. We might heard about people getting rich in stocks. But how much can a person realistically make from stocks in a month?

The amount of money you can earn in a month depends on two things: size of capital and rate of return. More money means more potential earnings or loss. Also, your rate of return depends on a lot of things. One of them is how long you stay on the market.

The average return over the last century in the stock market is around 10% per year. Market returns varies month to month. But over the long run, you can make around 1% per month on average from stocks by buying index funds and holding it. Buying individual stocks can offer you the best chance of earning more than 1% per month by beating the market.

Around 1% per month is the average over the long term. There are months that generates more than 1% and some months with less than 1%.

To give a perspective how much 1% is…

- Investment of $1 000 with 1% return is $10 per month

- Investment of $10 000 with 1% return is $100 per month

- Investment of $100 000 with 1% return is $1 000 per month

Investment returns varies month by month. One month could do great, the next month might do bad. Over the long term, the market moved one way, up. (10% average yearly return)

Picking individual stocks is one way to beat the market. The key is to minimize risks and maximizing returns by buying “great companies at a fair price” (Warren Buffet).

Average Market Returns

Every stocks has different returns. For simplicity, let’s use the S&P 500 index to track the average return of stocks. (S&P 500 is used to track the 500 biggest companies in America)

Let us take a look at some of the monthly returns in the past years.

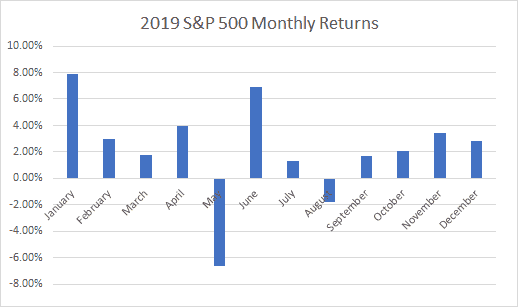

On Year 2019, the market has returned more than 1% in each of 10 months out of 12. Only 2 months in 2019 has negative return. Overall, the market has returned 28.88% on 2019.

If you invested $10 000 in S&P 500 on January 1, 2019, it became $12 883 at the end of the year. On the other hand, regular savings account at 2% will become $10 200 in a year with same capital.

While on 2018, there is 5 months out of 12 where the market returned more than 1%. And 7 months out of 12 with less than 1%. The market has returned -6.24% in 2018 overall.

For perspective, here are the monthly returns on year 2019:

2019 Monthly Returns

| January | 7.87% |

| February | 2.97% |

| March | 1.79% |

| April | 3.93% |

| May | -6.58% |

| June | 6.89% |

| July | 1.31% |

| August | -1.81% |

| September | 1.72% |

| October | 2.04% |

| November | 3.40% |

| December | 2.86% |

Something More Visual (Same Data)

The return changes every month because the market in unpredictable on the short term.

Even though the market lost 6% on the month of May, the market has returned a total of 28.88% for the year.

The best month is January with a return of 7.87% which is higher than the 1% average in the long term. Meanwhile, if you only invest on May, you would have lost 6.58%. But if you stayed the whole year, the overall return is 28.88%.

These returns are the market average. Beating the market means earning a higher return than the average. Since the average for 2019 is 28.88%, an investor or a mutual fund that earns 20% this year actually under perform the market.

At the same time, the market returned -6.88% on year 2018. A person or a mutual fund that loss 2% on 2018 actually beat the market by almost 4.88%.

The key is to stay invested in the market. America has experienced many recessions and crisis over the last century. And still, the S&P 500 is over 3 000 today. It was around 500 on 1970s, a 500% return in 50 years, which translates to an average return of around 1% per month.

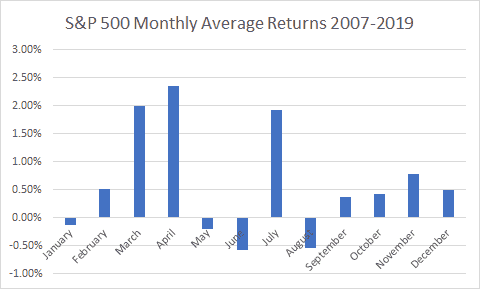

Monthly Returns Average

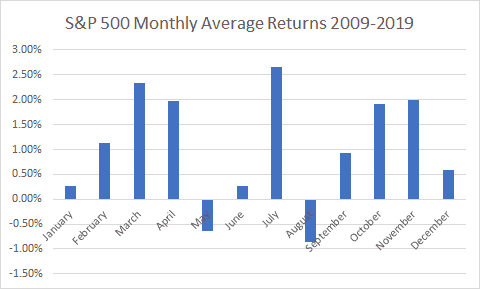

For longer duration market returns, here are the monthly returns of the S&P 500 from 2007 to 2019. We included 2007 since its the peak of the market before recession. Even if you invested before the market crash in 2008, you would have positive returns if stayed invested. Gains or loss are only realized when withdrawed.

Here are the monthly average returns before recession (2007) and after recession (2009) until 2019. Over the long run, the effects of recession on returns are reduced. No one can actually predict when a recession will happen. Market generally goes up over time.

Between the best and worst possible time to invest in the market, there is not so much difference in market returns in a 10 year period.

Active vs Passive Investing Returns

The returns mentioned above are the average returns. The goal of either active or passive investing is to beat the market.

When using the passive investing strategy, you should get a return right around the average. Many people are more suitable in passive investing as it requires little time to get started.

The returns on active investing strategy are more spread out. You could lose a lot of money in one month and gain a lot of money in next month.

The purpose of active investing is to return consistent income by gaining more than you lose. The goal of active investing is to gain a certain return each week. Let us say, 10% per month. If you are successful, you would have doubled your capital.

While the potential return/loss may be higher on active investing, it takes a lot of your time and emotional energy. It takes at least 4 hours a day in active trading and only a few makes money.

For most people, passive investing is the way to go as it only requires less than an hour for some weeks, and even no time necessary in a lot of time. Holding great businesses over the long term has been working for investors.

In either strategy, experience is the most valuable key into earning high returns in the market. In the beginning, it is advisable to start with little money and explore the market.

When starting, trying both active and passive investing with little money could teach you how the market works. After trying both strategies, you can know what strategy works better for you and stick to it.

“The best time to plant a tree was 20 years ago. The second best time is now.”

– Chinese Proverb