Interest Rates – EQ Bank vs Big Banks

| High Interest Savings Accounts | Interest Rates* |

| EQ Bank Saving’s Plus Account | 1.25% |

| RBC High Interest eSavings | 0.05% |

| TD High Interest Savings Account | 0.05% |

| Scotiabank MomentumPLUS Savings Account | 0.05% |

| CIBC eAdvantage® Savings Account | 0.05% |

*Base rates for each accounts. Big banks sometimes have promotional interest rates for new accounts, but promotional interest rates usually expires after 3-6 months and drops down to around 0.05%.

Who is EQ Bank?

EQ Bank is owned by Equitable Bank, a federally regulated Schedule I Bank with 900 employees and total assets under management of approximately $35 billion.

Equitable Bank was founded on 1970 as the Equitable Trust Company. It is a wholly owned subsidiary of Equitable Group Inc., whose common and preferred shares are traded on the Toronto Stock Exchange under the symbols EQB and EQB.PR.C, respectively.

EQ Bank is owned by Equitable Bank, a member of CDIC (like the big banks) and your funds are eligible for deposit insurance of up to $100,000 per account.

EQ Bank is named the #1 Bank in Canada on Forbes list of the World’s Best Banks on 2021

EQ Bank Pros and Cons

| Pros | Cons |

| No monthly fees | No physical branches |

| Free Interac e-Transfers® | No ATM access |

| Free Electronic Funds Transfers | No debit card |

| Free bill payments | |

| No minimum balance |

EQ Bank Platform

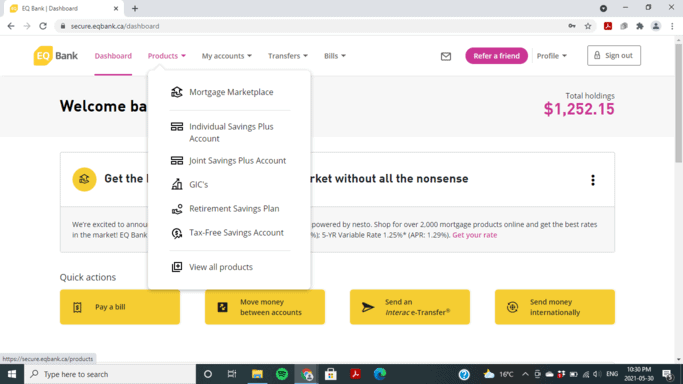

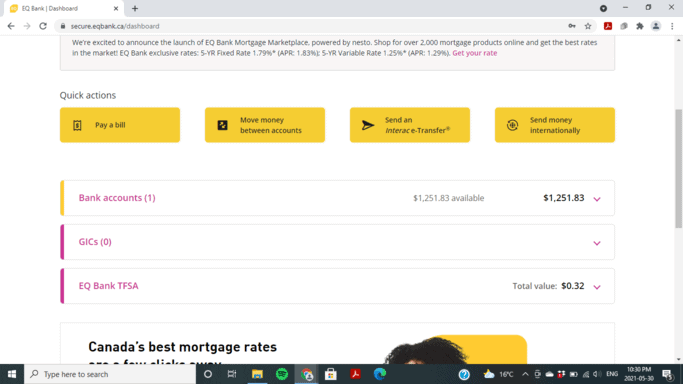

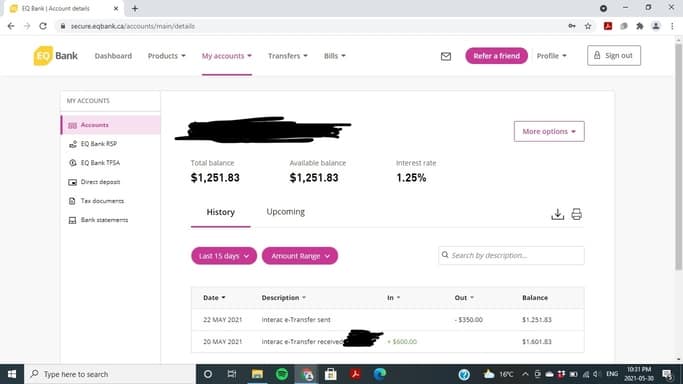

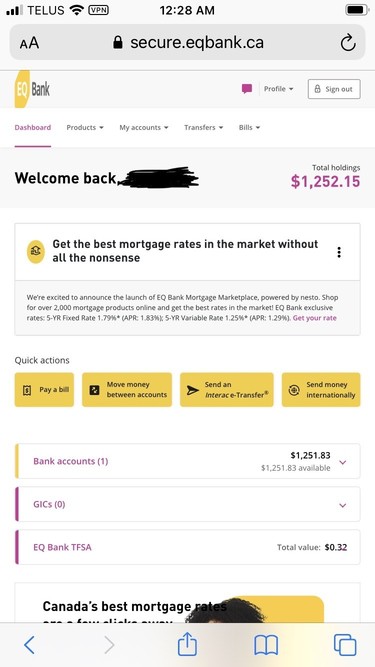

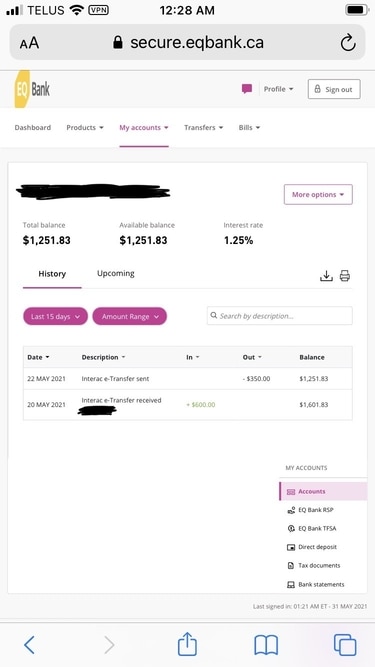

Here are some screenshots from my account on what the platform looks like.

Desktop

Smartphone

I removed some personal information like the bank number from the image.

Transferring Money to and from EQ Bank

Linking a bank account with EQ Bank is possible, but transfers usually takes 2-3 business days to transfer and withdraw using this method.

Another way is through Interac e-Transfers® which may be the most efficient way. Transferring though Interac e-Transfers® complete immediately, instead of waiting a couple of days. Also, money is transferred from a bank account to an email/phone number, to an EQ Bank account, and vice versa.

Holding Period

Amounts deposited can be withdrawn anytime. There is no minimum amount of time required to be able to withdraw it. For example, anyone can choose to withdraw any deposits made a day ago or even an hour ago.

On the contrary, GICs are locked on the term you choose. A 1 year GIC can only be withdrawn after a year.

Minimum Funding

EQ Bank has a $100 minimum requirement to purchase any GICs. However, there is no minimum balance required on deposits inside an EQ Bank TFSA, RSP, or Saving’s Plus account.